Invierte en tu primer producto DEFI

Ahora estás listo para comenzar a invertir en productos DeFi. Existen numerosas opciones, como préstamos, yield farming, staking y participación en pools de liquidez.

Para este manual, vamos a utilizar la plataforma líder en lending, Aave, donde siguiendo los pasos que te contamos a continuación delegaras los USDC que acabas de comprar en un pool de liquidez para que otros usuarios puedan utilizarlos. Los usuarios que los utilizan pagan una comisión y los que los delegan como en tu caso reciben unos rendimientos. Por lo que cuando retires la inversión tendrás más crypto de la que deposistaste.

El usuario que quiere utilizar los fondos del pool, que se conoce como pedir un préstamo, además de pagar la comisión tiene que poner como colateral otra moneda, este colateral se utilizará para pagar sus deudas si es necesario.

Esto se realiza entre otras razones para hacer inversiones con apalancamiento, yo tengo un BTC y lo utilizo como colateral para pedir USDC que, a su vez, utilizo para comprar más BTC de este modo tengo uno coma algo BTC, si el BTC sube ganaré más pero si baja perderé también más.

Además de hacerlo porque es razonablemente más sencillo, hemos elegido Aave porque sólo exige una moneda para entrar.

A continuación los pasos para realizar la operación:

- Accede a la plataforma Aave: Abre tu navegador y visita el sitio web oficial de Aave en https://app.aave.com/

- Conecta tu wallet: Si no te ha redireccionado, en la esquina superior derecha de la página de Aave, encontrarás la opción “Connect Wallet”. Haz clic en browser wallet para conectar tu MetaMask. Asegúrate de seleccionar la cuenta que contiene los fondos que deseas invertir.

- Confirma la red blockchain: Asegúrate de estar conectado a la red Blockchain correspondiente, en este caso Base. Puedes cambiar de red haciendo clic en el desplegable de la parte superior de la interfaz, donde se mostrará el nombre de la red en la que te encuentras actualmente. Cuando estés en Base te aparecerá por defecto la moneda ETH y el saldo de esa moneda que tienes en Metamask.

Asegúrate también de estar conectado a la red Blockchain correcta dentro de la plataforma Aave haciendo clic en el desplegable marcado en la captura de pantalla y seleccionando: Base Market.

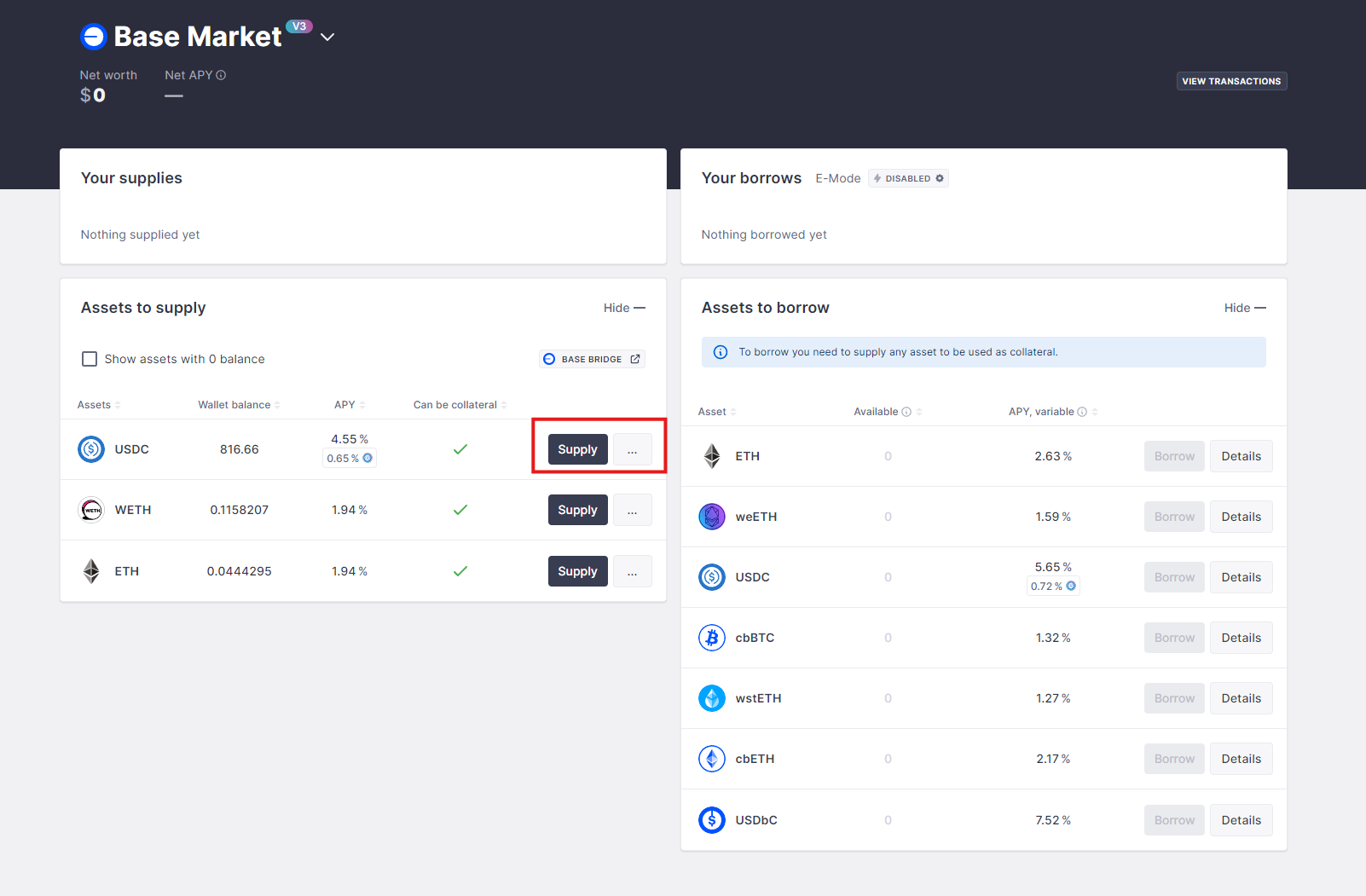

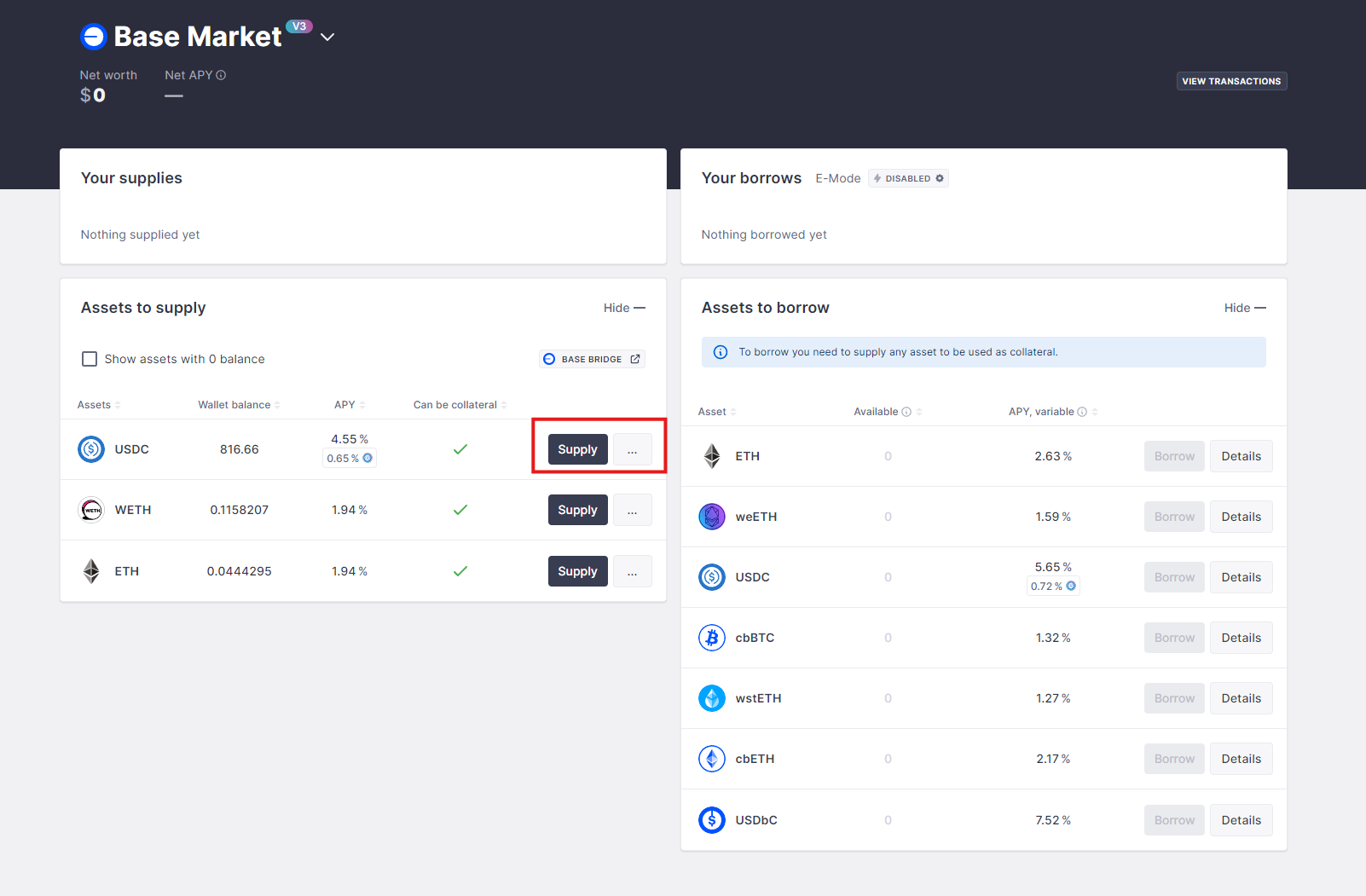

- Elige el token para invertir: Una vez conectado, podrás ver una lista de tokens disponibles en Aave para prestar o tomar prestado. Selecciona el token que deseas invertir. En este caso si has seguido los pasos anteriores elige USDC que es el token que has comprado en el punto anterior.

- Selecciona la opción “Supply”: Después de elegir el token, busca la opción “Supply” en la interfaz de Aave. Haz clic en ella para ingresar la cantidad de tokens que deseas prestar, en este caso todos los USDC que convertiste en el paso anterior. Aave te mostrará información sobre el interés que puedes ganar y los términos del préstamo.

- Confirma la transacción: Después de configurar los detalles del préstamo, revisa nuevamente la información proporcionada y haz clic en el botón “Confirm” o “Supply” para confirmar la transacción. MetaMask mostrará una ventana emergente donde podrás revisar y confirmar los detalles de la transacción, incluyendo las tarifas de gas estimadas.

- Espera a que se complete la transacción: Una vez confirmada la transacción, deberás esperar a que se complete en la red. Esto puede llevar algunos segundos o minutos, dependiendo de la congestión de la red y tarifas de gas seleccionadas.

Una vez completada la transacción, tus fondos se habrán invertido en el lending de Aave y comenzarás a ganar intereses según los términos establecidos. Puedes monitorear tus inversiones en la plataforma Aave y retirar tus fondos en cualquier momento si decides desinvertir.

Ya puedes avanzar al penúltimo paso de la guía!