El panorama financiero está cambiando a gran velocidad con la aparición de las finanzas descentralizadas (DeFi), una alternativa disruptiva a los sistemas tradicionales que ha captado la atención de millones de personas en todo el mundo. DeFi ha revolucionado la manera en que se gestionan los activos financieros, ofreciendo a los usuarios un acceso más directo, rápido y transparente a sus fondos. Y cada vez mas gente se hace la pregunta, TradFi vs DeFi ¿Cual es la mejor opción?.

No es de extrañar que, según la información de la plataforma DefiLlama, la cantidad de activos depositados en DeFi haya pasado de algo menos de $1000 millones a comienzos de 2020 a más de $150.000 millones en 2022, superando ampliamente el crecimiento de los activos gestionados por bancos tradicionales en el mismo período. Este impresionante crecimiento refleja la creciente confianza en DeFi como una opción financiera viable y atractiva. Sin embargo, la pregunta sigue siendo: ¿es DeFi la mejor opción para ti, o aún hay lugar para las finanzas tradicionales (TradFi)?

En este artículo, compararemos ambos sistemas, TradFi vs DeFi, explorando sus ventajas y desventajas, y explicaremos cómo Alldefi actúa como un nexo que conecta estos dos mundos, proporcionándote las herramientas y el soporte necesarios para navegar en esta nueva era financiera.

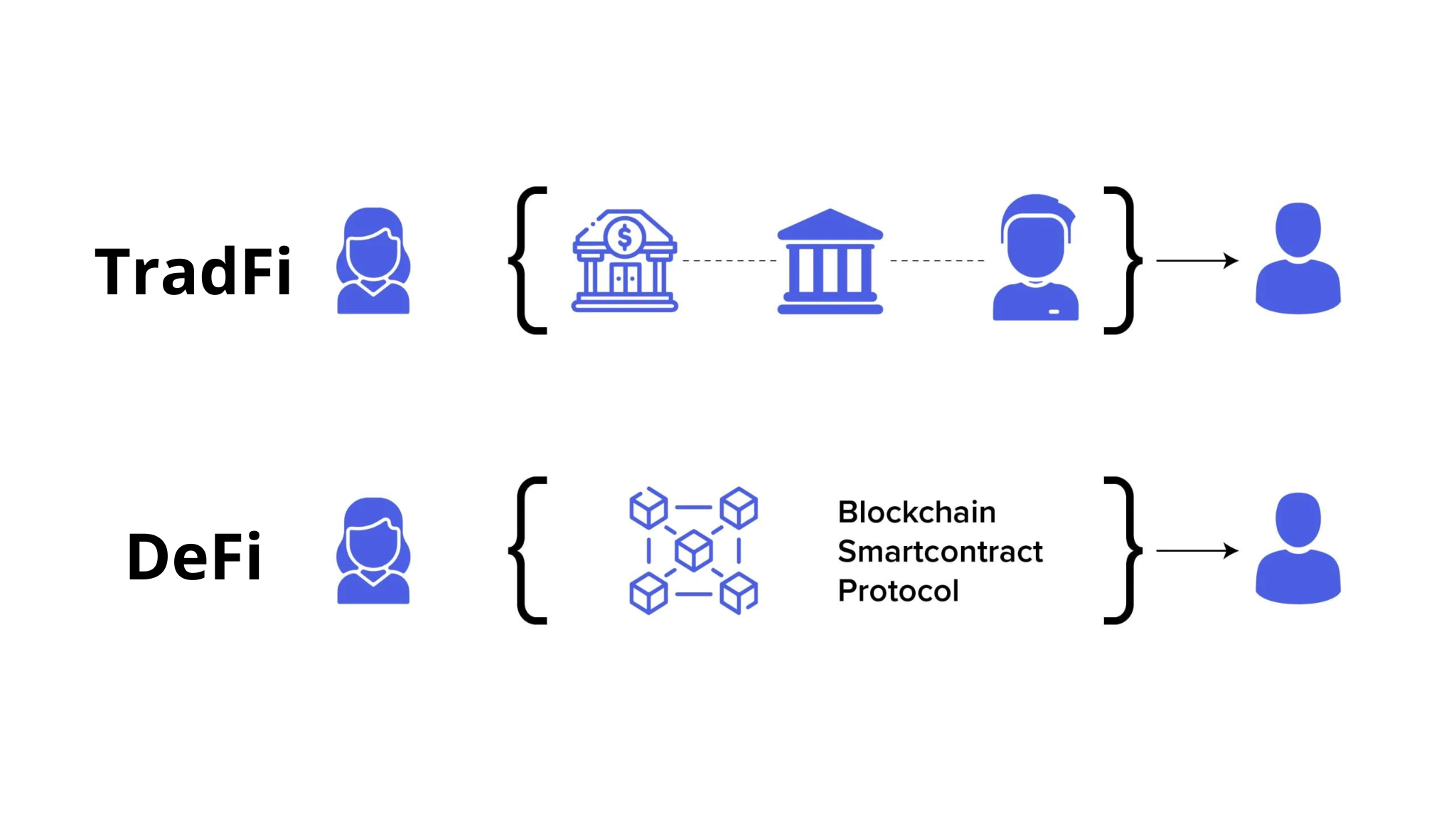

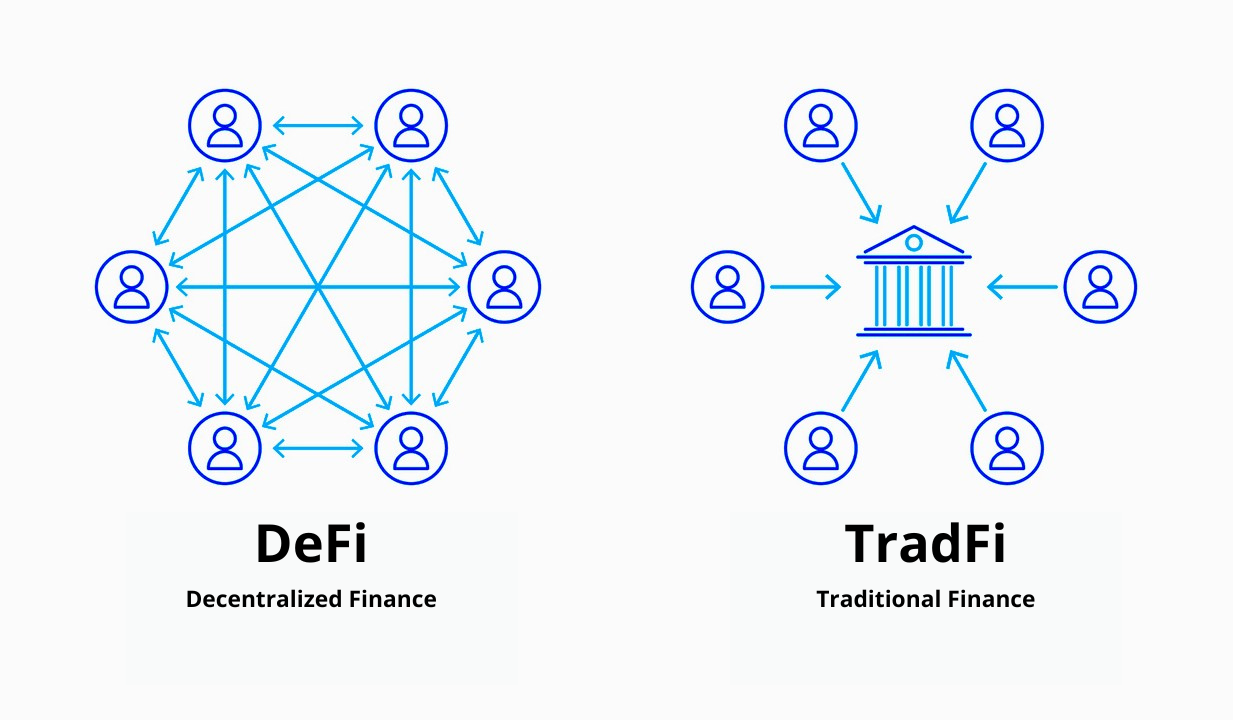

Las finanzas tradicionales han dominado el acceso al dinero durante décadas, pero este acceso no siempre es equitativo. Dependemos de bancos y otras instituciones para abrir cuentas, solicitar préstamos o invertir, y estos procesos suelen estar llenos de barreras burocráticas y costos ocultos. Además, los usuarios no siempre tienen el control directo sobre sus fondos.

DeFi ofrece una alternativa sin intermediarios, donde cualquier persona con una wallet digital puede participar. Desde enviar dinero hasta acceder a servicios financieros complejos, DeFi permite que los usuarios tengan el control total de sus activos. Sin embargo, gestionar todo por cuenta propia puede ser desafiante y riesgoso.

En las finanzas tradicionales, la transparencia a menudo se ve opacada por la complejidad de los procesos internos y la falta de visibilidad sobre cómo se gestionan los fondos. Aunque reguladas, estas instituciones no siempre ofrecen la claridad que los usuarios merecen. La peor recesión económica de los últimos 80 años, la gran crisis de 2008, ocurrió en gran parte debido a prácticas opacas en las principales instituciones financieras, lo que resaltó las debilidades del sistema financiero tradicional y la necesidad de mayor transparencia.

DeFi, en cambio, opera con una transparencia total gracias a la tecnología blockchain. Cada transacción se registra en un libro contable público y auditable, lo que minimiza el riesgo de manipulación o malversación. Sin embargo, este nivel de transparencia también trae consigo desafíos. Las estafas y actores fraudulentos representan una amenaza constante, pero estos riesgos pueden ser gestionados eficazmente mediante buenas prácticas de seguridad. Es crucial que los usuarios seleccionen plataformas seguras, se eduquen sobre los riesgos y apliquen medidas de protección para salvaguardar sus inversiones. Para aprender más sobre cómo protegerse en el mundo de DeFi, puedes consultar nuestra guía de seguridad en DeFi aquí.

La seguridad siempre ha sido una prioridad en el sector financiero. Los bancos están protegidos por leyes, seguros y estándares de ciberseguridad, pero no son inmunes a las fallas. Las brechas de datos son frecuentes, con muchas de las más grandes ocurriendo en instituciones financieras de Estados Unidos, lo que expone a millones de clientes y sus datos confidenciales como se detalla en este informe. Recientemente, el banco Santander, el segundo más grande de Europa, sufrió una brecha de datos en la que ni siquiera revelaron cuántos clientes se vieron afectados, subrayando la falta de transparencia en estos incidentes según Reuters.

En DeFi, la seguridad se centra en la tecnología blockchain y los contratos inteligentes, que aunque robustos, pueden tener vulnerabilidades si no se diseñan correctamente. Las estafas y actores fraudulentos representan una amenaza constante, pero estos riesgos pueden ser gestionados mediante buenas prácticas de seguridad. Existen firmas de auditoría especializadas, como Cyfrin y Quantstamp, dedicadas a la revisión de contratos inteligentes, que pueden mitigar estos riesgos al detectar y corregir vulnerabilidades antes de que los contratos sean desplegados. Es crucial que los usuarios seleccionen plataformas auditadas y mantengan un enfoque proactivo para proteger sus inversiones.

Las finanzas tradicionales están llenas de costos: desde comisiones por transferencia hasta tarifas de mantenimiento de cuentas, lo que puede dificultar la acumulación de ahorros o la optimización de tus inversiones. Estos costos son el precio a pagar por la infraestructura y los servicios de los bancos y otras instituciones financieras.

En DeFi, los costos se reducen gracias a la eliminación de intermediarios, aunque las tarifas de las transacciones en blockchain pueden variar dependiendo de la red y la demanda. Sin embargo, la competencia y la innovación constante están impulsando una reducción de estos costos, lo que convierte a DeFi en una opción cada vez más asequible.

Las oportunidades de inversión en las finanzas tradicionales, como los bonos y las acciones, son opciones consolidadas pero con rendimientos limitados. En DeFi, la variedad y potencial de retorno son mucho mayores, con opciones que van desde el staking hasta los pools de liquidez. Sin embargo, estas oportunidades también traen consigo un mayor nivel de riesgo y la necesidad de un conocimiento técnico más profundo.

| Característica | Finanzas Tradicionales | DeFi |

|---|---|---|

| Accesibilidad | Limitada por regulaciones, calificación crediticia, historial financiero o valor mínimo de activos, lo cual puede excluir a grandes segmentos de la población. | Abierta a cualquier persona con conexión a Internet. |

| Costos | Altas comisiones por servicios y mantenimiento, típicamente del 3% al 10% del valor de cada transacción. | Comisiones variables pero generalmente más bajas, a menudo menos de un centavo o tarifas fijas sin importar el tamaño de la transacción. |

| Velocidad de Transacciones | Puede tardar entre 2 y 14 días, especialmente en transferencias internacionales, que suelen demorar más. | Transacciones casi instantáneas, de segundos a minutos, dependiendo de la red blockchain. |

| Transparencia | Limitada, los procesos internos no son visibles. | Total, todas las transacciones son públicas y auditables en blockchain. |

| Seguridad | Protegida por regulaciones y seguros, aunque no exenta de brechas de datos y ciberataques. | Seguridad basada en la tecnología blockchain, con auditorías de contratos inteligentes para mitigar riesgos, aunque aún vulnerable a exploits en contratos no auditados. |

DeFi representa una oportunidad emocionante para quienes buscan más control y acceso a sus finanzas, sin los límites impuestos por los sistemas tradicionales. Alldefi actúa como tu conector, guiándote en cada paso hacia este nuevo ecosistema. Desde abrir tu cuenta hasta explorar oportunidades de inversión complejas, Alldefi facilita el proceso haciéndolo más claro y comprensible.

No se trata de abandonar lo conocido, sino de explorar lo nuevo con seguridad y confianza. Con Alldefi, puedes dar el salto hacia DeFi con las herramientas y el conocimiento que necesitas para tener éxito.