Interest in passive income streams with cryptocurrencies continues to rise, as more and more people look to harness the potential of blockchain technology to earn passive money with cryptocurrencies. With options ranging from staking to DeFi products, this article shows you six ways to generate passive income, including examples of specific platforms and a discussion of their advantages and disadvantages.

Hodling cryptocurrencies such as Bitcoin and Ethereum is one of the simplest methods to generate passive income. This strategy is based on holding these cryptocurrencies for the long term, expecting their value to increase over time. This method is ideal for those who are looking for a source of passive income and without the need to manage frequent transactions.

Like gold, Bitcoin and Ethereum are affected by market supply and demand. Hodling involves holding these assets with the expectation that their value will increase in the future. This strategy is suitable for those looking to maximize the growth potential of their investments and are willing to endure significant price fluctuations.

When comparing Bitcoin and Ethereum to traditional assets such as gold and bonds, there is a big difference in terms of yield, volatility and income stream:

Bitcoin shares with gold the characteristic of being a finite asset: gold is limited in nature, and Bitcoin has a maximum supply of 21 million coins. Both are considered reserves of value due to their scarcity. However, Bitcoin offers a faster appreciation capability, driven by growing digital adoption, albeit with a level of risk.

Platforms such as Binance, Coinbase and Kraken are popular options for the purchase and custody of cryptocurrencies. Coinbase, for example, offers secure storage services and options to store your cryptocurrencies in a proprietary wallet (Coinbase Wallet), which increases long-term security.

Staking through a centralized provider allows investors to lock their cryptocurrencies on an exchange to earn rewards. This method is popular for its simplicity, as it does not require advanced technical knowledge or the operation of nodes.

When staking on an exchange such as Binance or Kraken, your tokens are used to validate transactions on the blockchain. In return, you receive rewards in cryptocurrencies, calculated based on the amount of tokens staked and the network's rate of return.

Kraken and Binance are outstanding options for centralized staking. Binance allows the staking of more than 50 cryptocurrencies and offers a user-friendly interface. Kraken, on the other hand, is distinguished by its transparency in fees and its selection of cryptoassets.

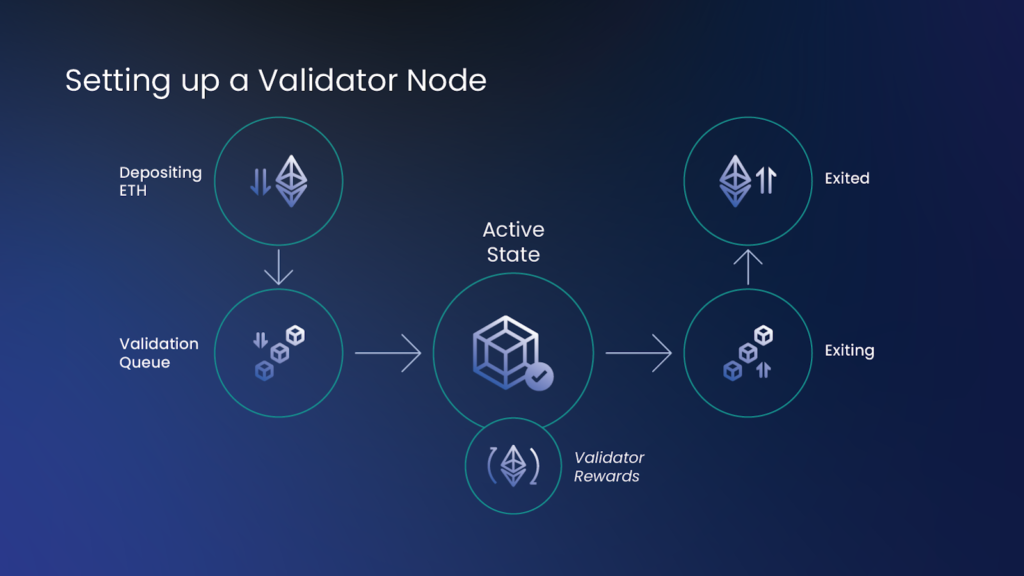

Staking as a node operator involves actively participating in the transaction validation of a proof-of-stake (PoS) blockchain network. This method is ideal for those who have the technical capability and resources to set up and maintain a node of their own. For example, on Ethereum, a minimum of 32 ETH is required to become a node operator and validate transactions.

For those who do not have the necessary 32 ETH or prefer not to manage a node, there are alternatives to liquid staking. liquid staking such as Rocket Pool and Lido Finance. These platforms allow staking in pools with lower entry requirements. In return, they issue liquidity tokens, such as rETH (Rocket Pool) or stETH (Lido), which represent the user's participation in staking and can be used on other DeFi platforms to earn additional returns. In this way, liquid staking provides the flexibility to maintain liquidity while generating staking rewards.

For those seeking exposure to the crypto market without the complexity of managing wallets, ETFs and crypto savings accounts are ideal options. These products allow you to profit from cryptocurrency appreciation or interest on stablecoins without dealing with direct custody of the assets.

ETFs (Exchange-Traded Funds) and crypto savings accounts are regulated options that offer investors a simplified way to access the cryptocurrency market without the need to manage a wallet. These products are ideal for those who want exposure to cryptoassets indirectly, rather than buying and holding them directly.

Until recently, U.S. Bitcoin ETFs have been based solely on Bitcoin futures, such as the ProShares Bitcoin Strategy ETF (BITO)launched in 2021. These ETFs track futures contracts and not the direct price of Bitcoin, which can cause differences between the value of the ETF and the spot price of the asset.

However, on September 20, 2024, the SEC(Securities and Exchange Commission) one of the main agencies in charge of overseeing and regulating the financial markets, approved BlackRock's first spot Bitcoin ETF, the BlackRock iShares Bitcoin Trust. This ETF tracks the spot price of Bitcoin, offering investors a direct and more faithful exposure to the market price of the asset. The approval of this product marks a significant milestone, as it makes it easier to invest in Bitcoin through traditional and regulated means, which could attract a wider audience and institutional capital into the crypto market.

With the advent of spot Bitcoin ETFs, the cryptocurrency market becomes more accessible, offering options for both those who prefer a futures-based approach and those seeking direct exposure to the Bitcoin price.

The world of DeFi offers a variety of ways to generate passive income through lending, staking, and liquidity provision, but doing DeFi on your own requires a specific set of skills and tools to manage the activity effectively and safely.

To get started at DeFi, it's critical to have a basic understanding of how cryptocurrency wallets and smart contracts work, as well as the risks and costs associated with blockchain transactions. Here we detail some key points to keep in mind:

Security is a key pillar in the DeFi ecosystem, and protecting your assets requires being well informed about best practices and potential risks. We invite you to read our article on DeFi Security where we explore the essential concepts to keep your funds safe, from wallet protection to smart contract attack prevention.

In conclusion, although doing DeFi on your own can be highly profitable, it requires good planning and the use of the right tools to optimize transaction management and risk control. Learning how to use these platforms and always being informed about changes in blockchain networks will be crucial to make the most of DeFi opportunities.

Finally, for those seeking passive income streams without the technical complexity, platforms such as Alldefi and Exponential select and manage DeFi products to maximize returns and minimize risk. These platforms curate staking, lending and liquidity provision options, simplifying the user experience and offering local regulatory compliance support.

Alldefi allows European investors to access DeFi strategies in a regulated manner and without worrying about technical details. On the other hand, Exponential offers a similar approach for the U.S. market, with a diversified portfolio that is managed in an automated fashion, saving users time and effort.

If you want an easy and secure way to participate in DeFi, explore Alldefi's products, which make investing in this market easy by taking care of the complex details for you. With Alldefi, you can access a diversified and regulated portfolio that allows you to maximize your returns without technical complications.

Whether through blue chip token hodling, operating your own node, or using curated platforms like Alldefi, the crypto ecosystem offers numerous ways to earn passive cash. Evaluate the options based on your needs and risk tolerance, and choose the strategy that best suits your financial goals. With platforms like Rocket Pool and Lido Finance, even staking has evolved to offer greater accessibility and liquidity, providing options for every type of investor.

Explore the world of DeFi and discover how to take advantage of the opportunities that the cryptocurrency market has to offer.