In the dynamic world of decentralized finance (DeFi), security is a critical factor for any investor. With the increasing adoption of DeFi platforms, so are the associated risks, from vulnerabilities in smart contracts to scams and exploits. At Alldefiwe understand the importance of protecting your digital assets, and we are committed to using the best security tools and practices in the market to safeguard your investments. Our mission is to allow you to focus on your financial goals without worrying about the technical details.

Before delving into security best practices and tools, it is essential to understand the main risks associated with DeFi:

At Alldefiwe apply a comprehensive security approach to ensure that your investments are always protected. Here are some of the best practices we follow and recommend:

When you interact with DeFi protocols, you grant permissions to smart contracts to move your funds. It is critical to revoke permissions you no longer need to minimize risk. Tools such as Revoke.cash y Etherscan Token Approvals allow you to manage and revoke the permissions of your assets in just a few steps.

At Alldefi, we continuously monitor the contracts we interact with and revoke those that are not necessary, ensuring that our users' funds are always under their control.

One of the best strategies to reduce risk in DeFi is diversification, both in the protocols you use and the types of assets you invest in. Users should seek to diversify their funds in:

At Alldefithis diversification is a fundamental pillar of our investment strategies, helping to minimize risks and maximize opportunities for our users.

To protect your investments, it is crucial to use protocols that perform external audits of your smart contracts with reputable firms like Cyfrin, Quantstamp, y Trail of Bits. These audits assess potential vulnerabilities in the code, but it is important to understand that they only address smart contract security and not other aspects of cybersecurity or operational security that protocols should adhere to.

At Alldefiwe go one step further. We don't just rely on external audits; we also conduct our own internal audits, carried out by a team of highly qualified cybersecurity professionals. Our internal audits are comprehensive and are based on a set of more than 20 criteria among which we rigorously evaluate:

These audits allow us to detect any potential vulnerabilities before users interact with contracts, providing an additional level of protection and confidence. At Alldefiwe not only verify the security of the code, but we comprehensively evaluate all factors that could impact the security of our users' investments.

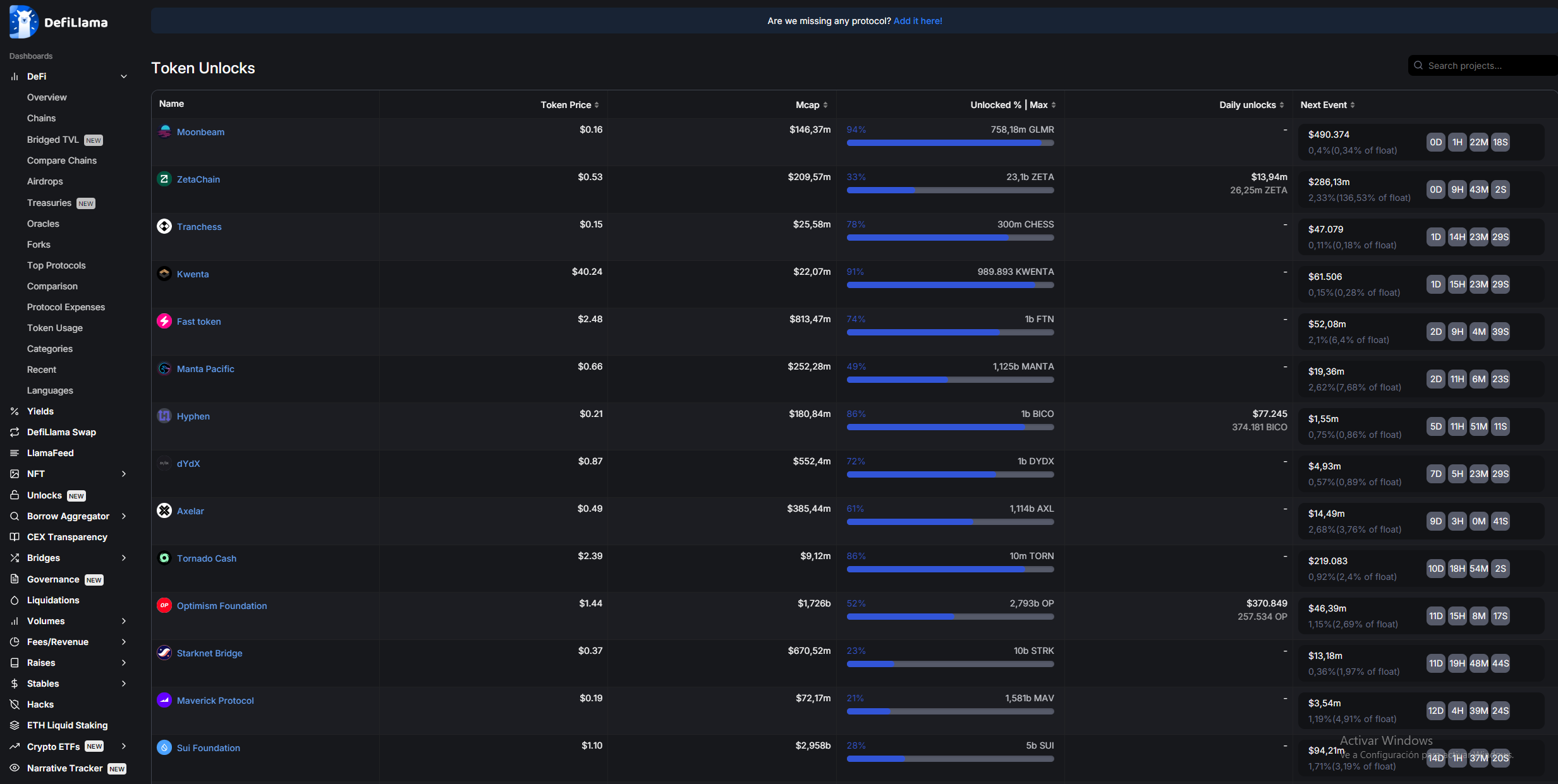

Many DeFi projects have scheduled token unlocks, which can impact the price and security of the asset. Alldefi uses advanced tools such as Token Unlocks to monitor these events and adjust strategies in real time, mitigating possible negative impacts on our users' portfolios. There are also other sources to check this information, such as the unlocks section of the platform Defillama.

The protection of your private keys is essential. We recommend the use of non-custodied wallets, such as Metamask o Trust Walletand hardware wallets such as Ledger o Trezor to protect your private keys and add an additional layer of security at a personal level.

At Alldefiwe use enterprise-grade security technology such as Fireblockscombined with secure wallet extensions such as Metamask Institutional o Rabby Wallet to ensure maximum asset protection. Fireblocks provides secure custody, attack prevention and secure transaction management through state-of-the-art encryption technology, ensuring that our operations maintain the highest level of security in the DeFi market.

When interacting with DeFi protocols, make sure that the contracts you connect to have been reviewed and are secure, and once you have confirmed their reliability, save them in a list of secure contracts. At Alldefiwe maintain a whitelist of secure contracts, regularly reviewed by our team. This list ensures that we only interact with reliable contracts, significantly reducing the risk of unnecessary exposures.

Continuing education is one of the most powerful tools for protecting your DeFi investments. Staying informed about the latest threats, vulnerabilities and security best practices is crucial for any investor. Here are some strategies and resources that can help you improve your knowledge and stay one step ahead:

At Alldefiwe provide our users with weekly information and updates on potential risks, along with educational content on safe practices in DeFi that helps strengthen their knowledge and protection in the ecosystem.

In the DeFi world, one of the most common risks is phishing attacks, where users are tricked into entering fake websites that steal their private passwords or funds.

Recommendations for Safe Access:

At Alldefiall our access protocols are verified by experts and only official and secure links are used. This practice significantly reduces the risk of phishing attacks and ensures that users always interact with the correct platforms.

At Alldefiwe not only apply security best practices, but use a combination of advanced tools and automated processes to protect our users' investments. Our approach includes:

Security at DeFi is not optional; it is an imperative. At Alldefiour priority is to provide you with a secure environment for your investments, using the best tools and practices in the market. This allows you to concentrate on achieving your financial goals while we take care of the technical details of security.