El ecosistema DeFi ha crecido exponencialmente en los últimos años, pero también lo ha hecho el número de ataques. Según un informe de Chainalysis, los hackeos en DeFi representaron el 82% de todos los fondos robados en criptomonedas en 2022, con pérdidas que alcanzaron los 3.1 mil millones de dólares. Muchas de estas brechas de seguridad ocurrieron debido a errores en la gestión de wallets y redes en DeFi y la falta de verificación de RPCs seguros, lo que facilitó ataques como el phishing, vulnerabilidades en contratos inteligentes y accesos no autorizados.

Este dato enfatiza la importancia de tomar precauciones y gestionar de forma eficiente wallets y redes en DeFi para evitar pérdidas.

La gestión de múltiples wallets y redes se ha convertido en un reto importante para los usuarios de DeFi, especialmente a medida que el ecosistema sigue creciendo y diversificándose. La necesidad de manejar diferentes tipos de wallets, añadir nuevas redes de forma segura y optimizar el uso de RPCs puede resultar abrumadora.

En este artículo, te proporcionamos una guía práctica con recomendaciones y herramientas que te ayudarán a gestionar tus activos de manera eficiente y segura.

1. Dashboards para la Gestión de Activos: Controla Todo en un Solo Lugar

Los dashboards como Debank, Zapper o Zerion son herramientas esenciales para cualquier usuario de DeFi. Estos paneles te permiten ver y gestionar todos tus activos de múltiples wallets en un solo lugar, facilitando el monitoreo de balances, transacciones y rendimiento de tus inversiones.

- Seguridad frente a Estafas y Hackeos: Al centralizar la gestión de tus activos en un solo lugar, los dashboards te permiten mantener un control más preciso de tus fondos, detectando movimientos inusuales o potencialmente fraudulentos de manera rápida. Esto reduce el riesgo de ser víctima de estafas o hackeos, ya que puedes monitorear todas tus wallets desde una única interfaz y recibir alertas sobre cambios repentinos en los balances. Además, al conectar únicamente wallets verificadas y con soporte de múltiples redes, reduces el riesgo de interacción con contratos maliciosos.

- Debank: Ofrece una vista detallada de tus activos, incluyendo NFTs, y soporte para múltiples cadenas de bloques. Además, proporciona análisis detallados que pueden ayudar a identificar contratos sospechosos o actividades inusuales en tu cuenta.

- Zapper: Además de gestionar activos, te permite interactuar con diferentes protocolos DeFi desde la misma interfaz, lo que facilita un seguimiento más seguro de las actividades de farming y staking, minimizando los riesgos de interactuar con contratos vulnerables.

- Zerion: Ofrece una experiencia de usuario amigable y soporte para varios tipos de wallets, lo que hace que la gestión de tus activos sea más intuitiva. También permite una integración segura con DApps, evitando conexiones inseguras.

Estos dashboards no solo simplifican la gestión de activos, sino que también actúan como una capa adicional de protección contra posibles fraudes o hackeos al proporcionar visibilidad en tiempo real de todas tus wallets y actividades. La posibilidad de verificar rápidamente el estado de tus fondos y transacciones desde una única plataforma puede ser clave para prevenir pérdidas y detectar comportamientos inusuales antes de que se conviertan en un problema

2. Diversificación de Wallets: Encuentra la que Mejor se Adapta a tus Necesidades

La elección de una wallet es fundamental para la experiencia de usuario en DeFi. Además de la facilidad de uso, la seguridad es un aspecto crítico, ya que muchas vulnerabilidades en DeFi provienen de la mala gestión de wallets o del uso de wallets inseguras. A continuación, exploramos algunas de las opciones más populares y sus niveles de seguridad:

- Metamask: Es la wallet más utilizada en DeFi, compatible con múltiples redes y fácil de configurar. Sin embargo, su popularidad también la convierte en un objetivo atractivo para los hackers. Si no se configura correctamente, es susceptible a ataques de phishing y malware. A pesar de esto, cuando se usa con las configuraciones de seguridad adecuadas, como la protección mediante hardware wallets (como Ledger o Trezor), sigue siendo una opción sólida.

- Rabby Wallet: Esta wallet se destaca por su enfoque en la seguridad, integrándose directamente con las DApps y proporcionando una función única de análisis de transacciones antes de que sean confirmadas. Esto permite a los usuarios verificar posibles riesgos de seguridad, como la interacción con contratos inteligentes maliciosos. Además, en Alldefi utilizamos Rabby Wallet a través de la extensión de Fireblocks, lo que añade una capa adicional de seguridad a nivel empresarial, minimizando los riesgos operativos y mejorando la protección de los activos.

- Fireblocks: Es una de las soluciones más seguras para la custodia de activos digitales a nivel empresarial. Empresas como Alldefi utilizan Fireblocks debido a su tecnología avanzada de seguridad, que incluye almacenamiento de claves en módulos de seguridad de hardware (HSM) y aprobación de transacciones mediante múltiples firmas. Este nivel de seguridad empresarial reduce drásticamente las posibilidades de hackeos y accesos no autorizados.

- Trust Wallet: Ideal para usuarios móviles, es compatible con una gran variedad de blockchains y ofrece soporte para la compra directa de criptoactivos desde la app. Aunque no ha sido el objetivo de tantos hackeos como otras wallets más populares, sigue siendo esencial utilizar medidas adicionales de seguridad, como el uso de frases de recuperación seguras y la activación de autenticación en dos pasos (2FA) donde sea posible.

Seguridad en el uso de wallets: Es importante destacar que, aunque algunas wallets tienen una reputación más sólida en términos de seguridad, el uso adecuado de cada wallet es lo que realmente marca la diferencia. El uso de hardware wallets, la verificación constante de transacciones y la conexión a redes confiables puede reducir significativamente el riesgo de hackeos, estafas y pérdidas.

3. Adición Segura de Redes: Evita Riesgos con Chainlist y Prácticas Seguras

Agregar nuevas redes a tu wallet es una tarea común en DeFi, pero hacerlo de forma segura es crucial para evitar riesgos de phishing y errores que podrían comprometer tus activos. Elegir correctamente las redes a las que te conectas puede prevenir vulnerabilidades críticas que los hackers suelen explotar. De hecho, múltiples hackeos en DeFi han ocurrido por la adición de redes o interacciones con contratos inteligentes inseguros.

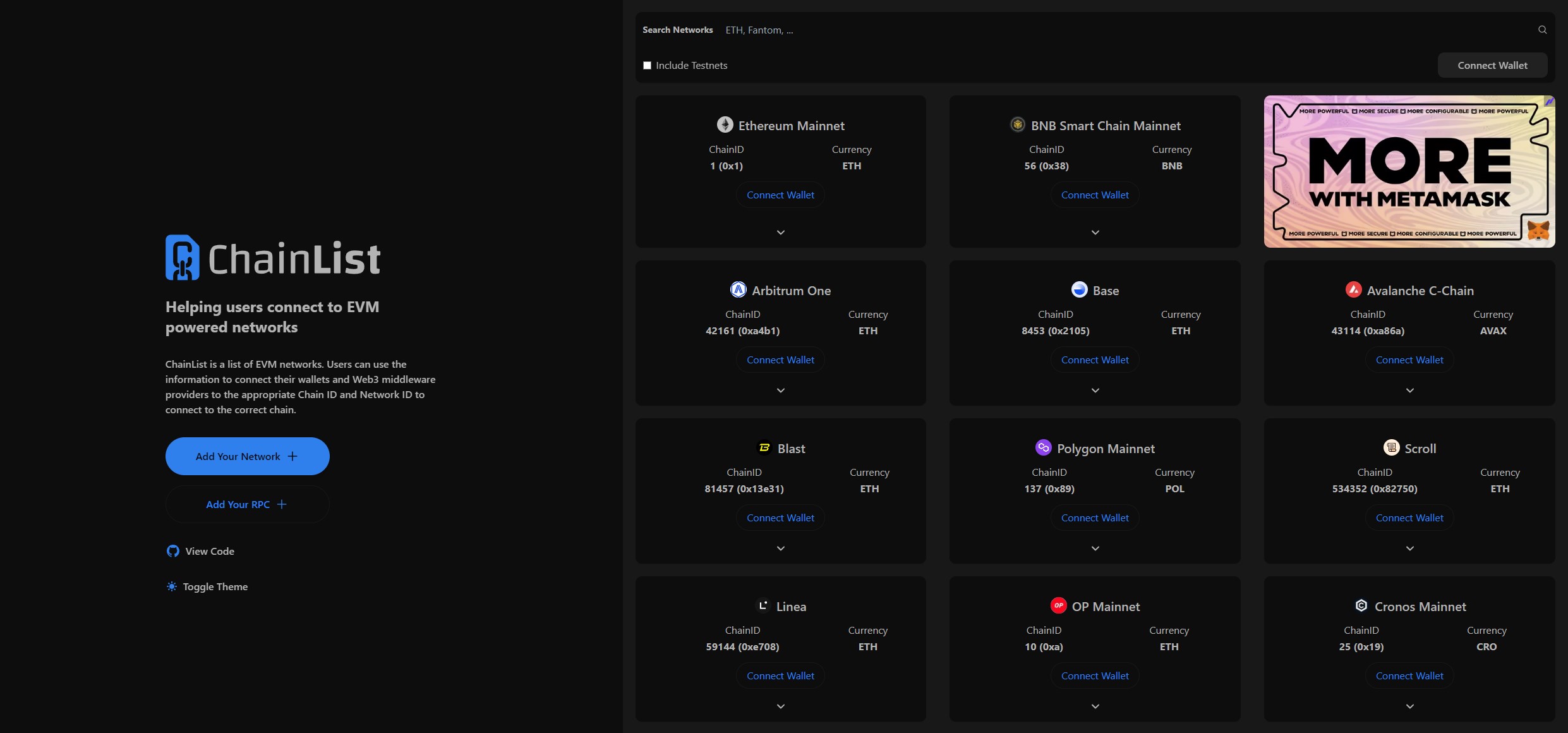

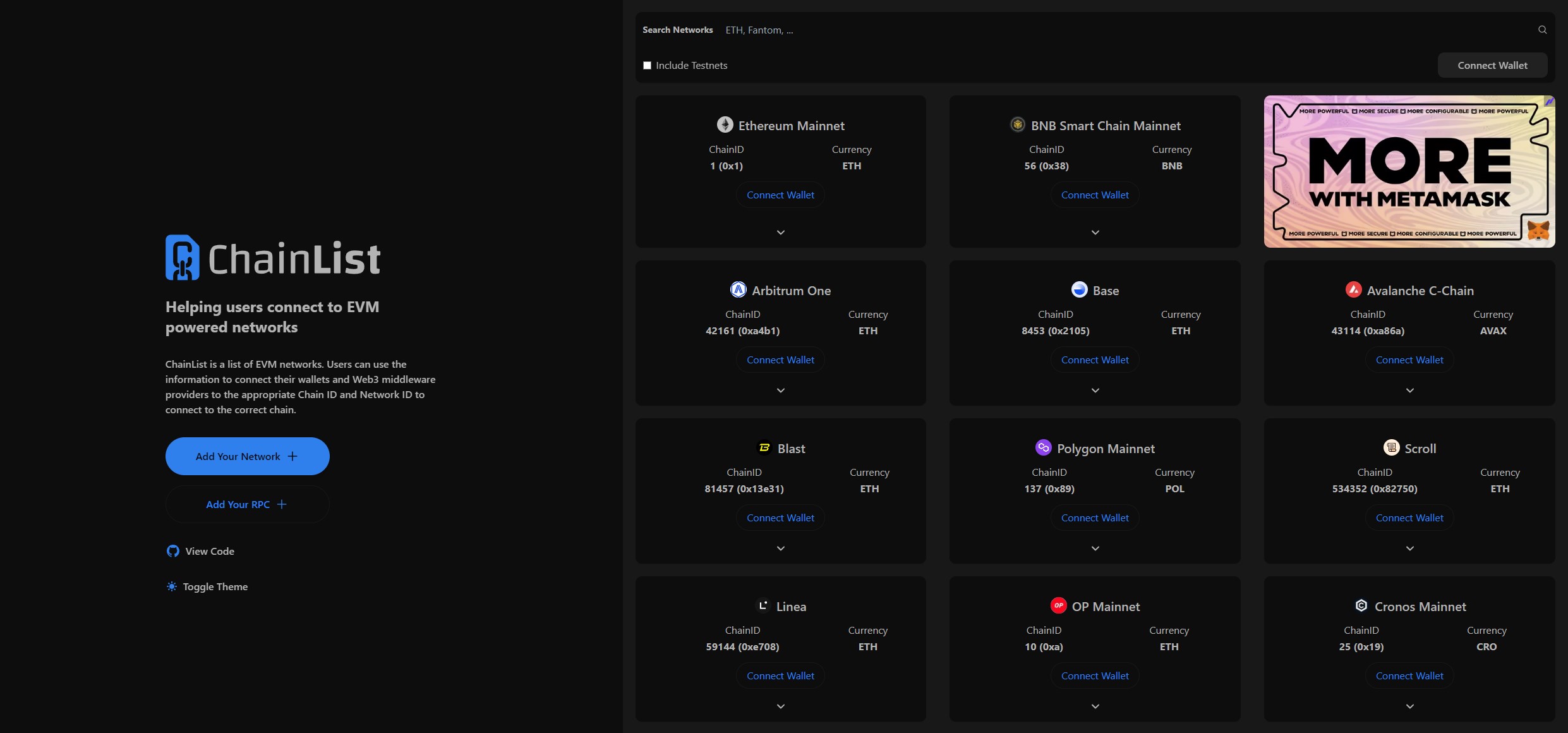

- Chainlist: Esta herramienta facilita la adición de redes a wallets como Metamask de forma rápida y segura. Con un solo clic, puedes agregar redes verificadas, lo que garantiza que la información que estás utilizando proviene de fuentes oficiales. Al eliminar el proceso manual, se minimiza el riesgo de que los usuarios ingresen datos incorrectos o se conecten a redes maliciosas que podrían poner en riesgo sus fondos.

- Ventajas de Seguridad: Chainlist actúa como un filtro de seguridad, asegurando que los RPCs y otras configuraciones críticas provengan de fuentes confiables. De esta manera, se reduce significativamente la probabilidad de caer en ataques de phishing o ser redirigido a redes falsas, donde los hackers podrían intentar robar fondos o información privada.

- Buenas Prácticas al Añadir Redes: Aunque herramientas como Chainlist simplifican el proceso, es importante verificar siempre la legitimidad de la red a la que te conectas, utilizando fuentes oficiales o comunidades verificadas. Evitar conexiones a redes desconocidas o no verificadas es una de las mejores prácticas para reducir riesgos.

Impacto en la Seguridad: Muchos usuarios han sido hackeados por añadir redes manualmente con información incorrecta, lo que permitió a atacantes interceptar transacciones o redirigir fondos a wallets maliciosas. Usar herramientas seguras como Chainlist puede mitigar estos riesgos y asegurar que tu wallet solo se conecte a redes confiables.

4. ¿Qué son los RPCs y Cómo Configurarlos para Mejorar la Seguridad?

Los RPCs (Remote Procedure Calls) son protocolos que permiten que tu wallet se comunique con la blockchain. Actúan como un puente para realizar operaciones como enviar transacciones, consultar balances y ejecutar contratos inteligentes. Sin un RPC adecuado, tu wallet no podría interactuar de manera efectiva con la blockchain, lo que puede exponer tus activos a vulnerabilidades.

- Importancia de los RPCs Seguros: Si un RPC está comprometido o es malicioso, los hackers pueden interceptar información sensible o, en algunos casos, realizar transacciones maliciosas sin tu autorización. Configurar correctamente el RPC y verificar que no solicite permisos inusuales, como el acceso a tus claves privadas, es esencial para proteger tus activos.

- Verificación de Seguridad de los RPCs: Al cambiar los RPCs, siempre es importante verificar que provengan de fuentes confiables, como los sitios web oficiales de las redes blockchain o plataformas seguras como Chainlist. Evitar el uso de datos de fuentes no verificadas es clave para mantener la seguridad de tus activos.

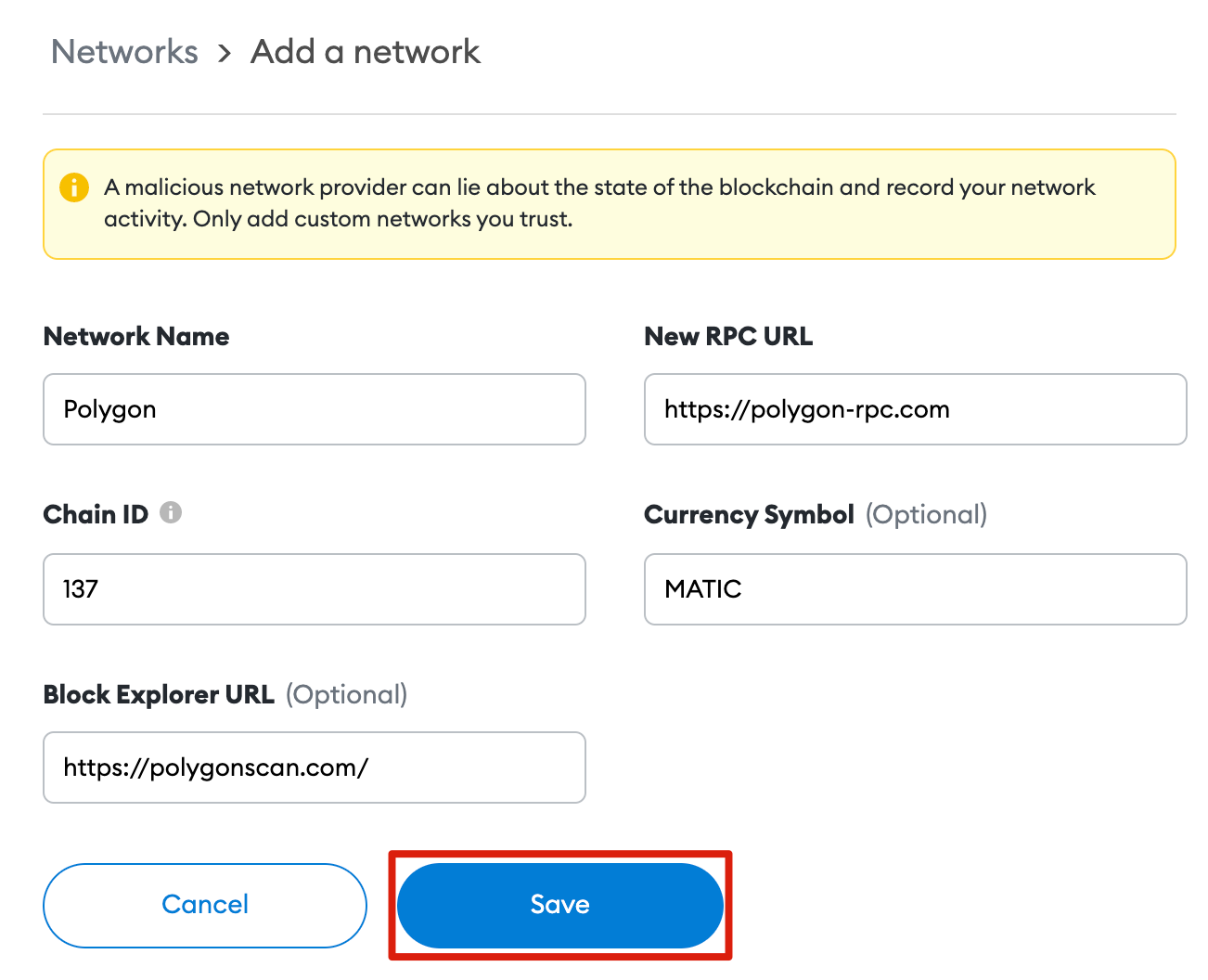

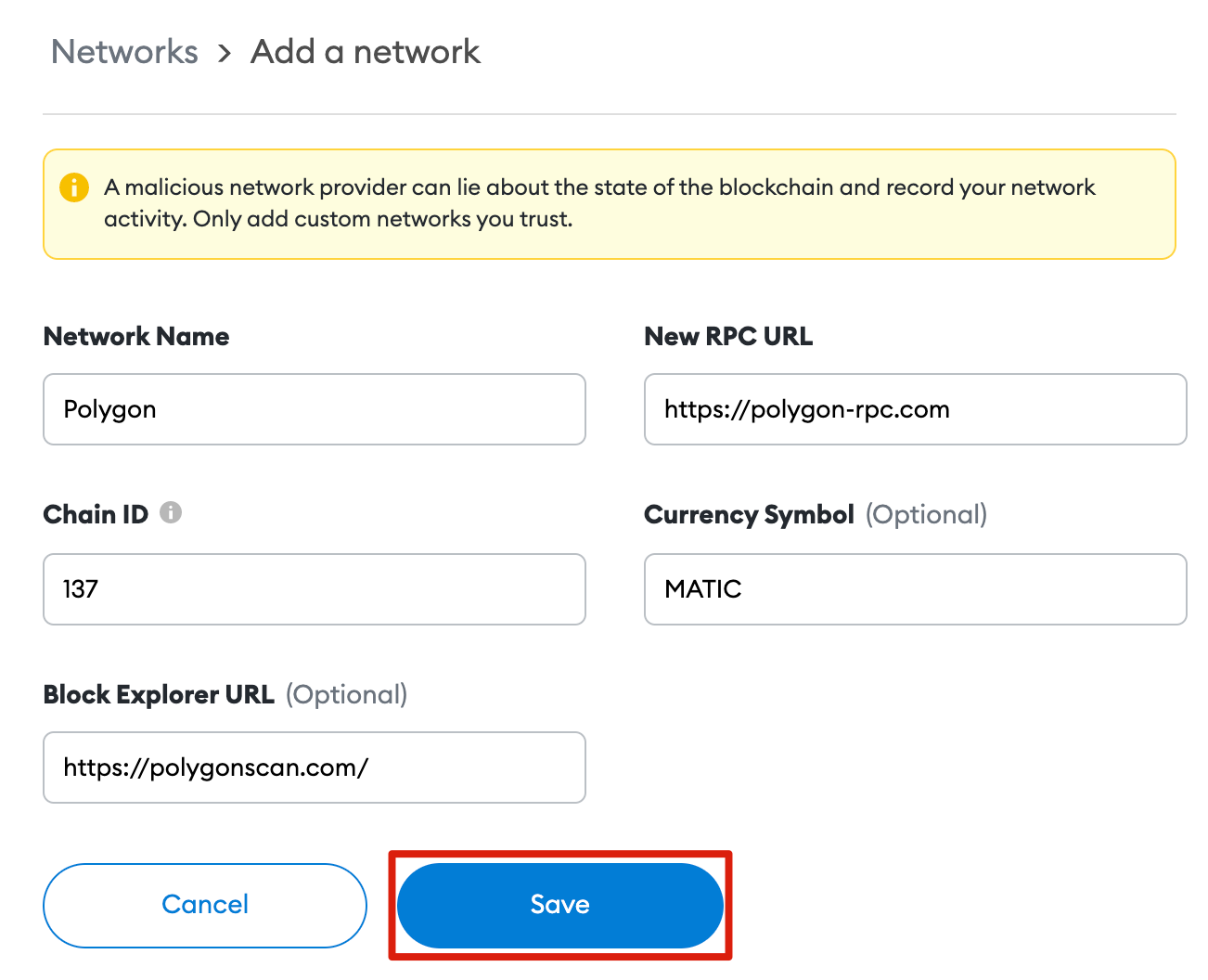

Cómo Cambiar el RPC Predeterminado en Metamask:

- Accede a la Configuración de Redes:

- Abre Metamask y haz clic en el ícono de tu perfil en la parte superior derecha.

- Selecciona «Configuración» y luego «Redes».

- Selecciona la Red que Deseas Modificar:

- En la lista de redes, elige la red cuyo RPC deseas cambiar (por ejemplo, Ethereum Mainnet).

- Edita el RPC:

- Haz clic en la red y verás un campo llamado «URL de RPC». Introduce la nueva URL del RPC que quieres utilizar.

- Asegúrate de que la URL del RPC provenga de una fuente confiable y segura, como los sitios oficiales de la red o proveedores reconocidos.

- Guarda los Cambios:

- Después de introducir la nueva URL del RPC, guarda los cambios y cierra la configuración.

- Verifica la Conexión:

- Una vez cambiado, verifica que tu wallet esté conectando correctamente con la red y que las transacciones se procesen sin problemas.

Beneficios de Cambiar el RPC: Cambiar el RPC en Metamask no solo puede mejorar la conectividad y reducir los tiempos de espera, sino que también puede incrementar la seguridad en la gestión de tus wallets y redes DeFi si eliges un proveedor de RPC de calidad y reconocido. Esto garantiza una mejor experiencia de usuario y reduce la posibilidad de ataques relacionados con la infraestructura de la red

Alldefi: Simplifica la Gestión de tus Activos, wallets y redes en DeFi

En Alldefi, entendemos que gestionar múltiples wallets y redes en DeFi y optimizar el uso de RPCs puede ser un desafío complejo, especialmente para aquellos que recién se adentran en el mundo DeFi. Nuestro objetivo es ser el nexo que conecta todas estas soluciones en una plataforma intuitiva y accesible, para que puedas centrarte en lo que realmente importa: maximizar tus oportunidades en DeFi de manera segura y eficiente.

¿Por qué elegir Alldefi?

- Gestión Centralizada: Alldefi ofrece una experiencia unificada, eliminando la necesidad de saltar entre diferentes wallets y dashboards. Todo lo que necesitas lo encontrarás en un solo lugar.

- Interfaz Amigable: Diseñada para ser intuitiva, nuestra plataforma te permite acceder a tus activos y realizar transacciones sin complicaciones técnicas.

- Experiencia Simplificada: Nos centramos en reducir la complejidad, ayudándote a gestionar tus activos de forma sencilla y sin las complicaciones técnicas que suelen acompañar al uso de múltiples herramientas en DeFi.

- Recursos Informativos: Aunque no ofrecemos soporte personalizado, en Alldefi podrás encontrar recursos educativos y guías que te ayudarán a entender mejor el ecosistema y a tomar decisiones informadas.

Con Alldefi, no tienes que preocuparte por la complejidad de gestionar múltiples herramientas y configuraciones. Simplificamos tu experiencia en DeFi, brindándote control total sobre tus activos y ayudándote a superar los desafíos que enfrentan tanto los principiantes como los usuarios avanzados. Únete a Alldefi y descubre una manera más sencilla y eficiente de interactuar con el futuro financiero descentralizado.